RARELY in economic or financial history has as much turmoil been visited upon the world in a single year as has happened during 2008. To name but a few events, we have seen the collapse of one-time blue-chip institutions like Bear Stearns and Lehman Brothers; the bailouts of others, including the insurance giant AIG, the US government-linked mortgage lenders Fannie Mae and Freddie Mac, and also household names like Citigroup, the Royal Bank of Scotland and Lloyd's Bank. Major international banks have been recapitalised with taxpayer funds and some have been effectively nationalised, which hardly anyone would have dared to predict at the start of the year. There has been wealth destruction on a scale not seen since the Great Depression; indeed, this financial crisis is believed to be the worst since the terrible 1930s - something most of us never experienced.

The US Federal Reserve, after being behind the curve in the run-up to the crisis, has gone into overdrive. It opened various lending windows, funnelling more than US$1 trillion to financial institutions, taking even toxic mortgage debt as collateral. It slashed interest rates aggressively from 4.25 per cent for the Fed funds at the start of the year, to near zero. It also adopted an unorthodox policy of quantitative easing. The US Treasury came up with a US$700 billion financial bailout package.

In the background to all this turmoil was the tension and drama of the US presidential election, which produced the first African-American winner. Early indications suggest that Barack Obama might just be a leader of vision and decisiveness, the singular silver lining amid the dark clouds that dominated 2008. The year ended with news of a mind-boggling financial fraud estimated at US$50 billion, perpetrated by one-time respected financier Bernard Madoff. It was perhaps a fittingly shocking end to an annus horribilis.

For those of us on the other side of the world from the epicentre of the storm, the financial crisis has revealed some sobering truths. One is that the idea of 'decoupling' - that Asia's economies had somehow acquired an independent dynamic of their own - was a fantasy. The Singapore economy has gone from 7.7 per cent growth in 2007 to almost certain recession, and probably negative growth in 2009. Just about every Asian economy is feeling the downdraft of the made-in-America financial crisis. Even China and India, which were assumed to be relatively insulated, have been hard hit; their stock markets have, in fact, been the worst performers in Asia this year.

The financial storm is far from over, but we have some indications what 2009 might have in store. It will be a year of global recession. But it will also be one of dramatic policy moves, including perhaps the biggest-ever economic stimulus packages in history. It will be a year of tighter financial regulation, conservative, 'back-to-basics' banking and risk-averse investing. In short, 2009 promises to be the year of the hangover after a decade of financial excess. Hopefully, it will also be the year of the recovery, however slight.

There are plenty of technical analysis indicator in the market. I would prefer a simplified but money making indicator. One of it is William Percentage.

I am looking at StraitAsia now. Same signal has generate decent profit 4 times whenever it occurred since September 2008 as per the chart attached herewith. With the signal generated now, this stock shall generate a profit in coming next few days.

Chart:

Guess what? Recession? no way!

It is time to check your irrational spending habit. Nope, probably your wife/gf!

Picture from : http://www.kennysia.com/archives/2008/12/theres_a_queue.php

Quote BT today:

RECESSION or not, high-end retail brands such as Chanel and Louis Vuitton are still going ahead with plans to launch new stores and expand existing ones.

And with malls such as Ion Orchard, Orchard Central and the new Mandarin Gallery coming on-stream next year, consumers can also look forward to various new-to-Singapore brands.

Chanel, for one, will be launching a new watch and fine jewellery stand-alone store in Singapore at Ngee Ann City in March 2009, the first such store in South-east Asia, although Chanel has already launched its fine jewellery boutique in other parts of Asia such as China and Korea.

Chanel remains upbeat that the new store will do well, even with the deteriorating economy and dampening consumer sentiment. 'We've done our research,' said a Chanel spokesman, adding that the new concept will fulfil customer demands for such a store.

The industrial property sector, which had grown at a steady pace for most of 2008, is unlikely to escape from the economic downturn that has hit its residential and office counterparts.

As manufacturing activity dips and relocations from offices slow, some property consultants believe that industrial rents and capital values could register double-digit percentage falls starting from Q4 2008. Industries could also start sub-letting space that they no longer need.

'With an expected slowdown in GDP growth and poor expectations of the performance of the manufacturing sector, demand for industrial space is likely to moderate,' said DTZ's senior director of research Chua Chor Hoon.

'The fourth quarter could be the turning point,' noted Knight Frank's head of industrial business space Lim Kien Kim.

According to DTZ data, growth within the industrial sector in the first three quarters of the year pushed the average rent of first-storey private industrial space up 6.8 per cent to $2.35 per sq ft per month (psf pm) in Q3. That of upper-storey space rose 7.9 per cent to $2.05 psf pm.

But rents could slide in Q4 as the manufacturing sector cools, said Ms Chua. The Singapore Purchasing Managers' Index fell for the third straight month in November, reflecting tougher times for manufacturers.

DTZ estimates that average rents of first-storey and upper-storey private industrial space could each drop by more than 2 per cent from the previous quarter to $2.30 and $2.00 psf pm, respectively, in Q4.

High-tech and business park spaces are likely to face the same sinking fate. Rents had jumped 15.4 per cent to $4.50 psf pm in the first three quarters, largely because more companies were moving over to avoid soaring office rentals.

The average occupancy rate in private sector business parks notched up 6.3 percentage points from Q4 last year to 93.2 per cent in Q3 2008, said DTZ.

'Businesses, including those occupying prime office space, increasingly found business parks to be attractive alternatives for housing approved back- end operations,' said Mr Lim.

But such spillover demand could slow as office rents fall amid a weakening economy. DTZ projects that the average rent of high-tech and business park space could drop to $4.30 psf pm in Q4, more than 4 per cent down from Q3.

As Colliers International's research and advisory director Tay Huey Ying said: 'Modern light-industrial and hi-specs industrial buildings would be worst hit as they will suffer from the double whammy of slowdown in demand from industrialists as well as from office users.'

She noted, however, that the industrial property sector had started to cool from the second half of 2008. Colliers's data pointed to a slight fall in rents of hi-specs space in H2, while those of factories and warehouses stayed flat in the same period.

As the downturn hits businesses, industrial tenants could start moving to cheaper locations, said Ms Tay. She also expects more downsizing companies to sub-let part of their premises.

DTZ's Ms Chua shared similar views. 'We may see some shadow space in the industrial sector next year, like what we are beginning to see in the office sector, as more companies consolidate their operations.'

Industrial landlord JTC Corporation has been taking back more space as manufacturing and related companies merged their operations. According to its quarterly facilities report for Q3 2008, termination at its ready-built facilities surged 25.7 per cent quarter-on-quarter and 45 per cent year-on-year.

'Industrial landlords could be more flexible in the coming months in order to maintain the occupancy levels of their industrial portfolio,' said Knight Frank's Mr Lim.

He estimates that for 2009, industrial rents could slide 7-12 per cent and prices by 10-15 per cent, with modern industrial space and business parks facing greater declines.

Ms Tay from Colliers believes that rents of conventional flatted factories and warehouses could drop by 12-15 per cent next year, while those of hi-specs industrial space could fall further by up to 20 per cent.

'Capital values are expected to soften by the same quantum as industrialists choose to conserve cash for their business operations instead of investing in an industrial unit,' she said.

Economic uncertainty has already spurred the Trade and Industry Ministry to suspend sales of state-owned industrial land on the Confirmed List for the first half of 2009.

While industrial rents and prices will fall, the sector is nowhere near a crash. 'The speculative element in industrial sector is not major,' said Mr Lim. As prices moderate to more realistic levels, 'the correction will be good as it will again draw investments back into industrial activities for Singapore'.

After successful breakout of Biosensor last week, this week the turn is China Milk to get the caption of “Poised for Breakout”.

“Poised for Breakout” seems likely to be more attractive in comparison to “Breaking out” as the former means the price has not moved and the latter means whoever buy now is buying at height.

The Edge---> China Milk ($0.41) is in a base formation. Quarterly momentum has strengthened notably. The breakout level is 41 cents and a successful breakout indicates a target of 56 cents.

Chart here:

I think they should have better way to position the news.

One week after the comment that Biosensor is 'poised for a breakout', let's take a look at the actual performance now.

The stock did broke out on Monday as predicted to $0.34 from $0.29 with unusual high volume. However, the initial target of $0.40 has not been achieved. Instead of that, it falled back to close at $0.315 last Friday, very close to its base formation level at $0.31.

Nonetheless, the high at $0.345 is indeed a bullish sign. Initial target of $0.40 is still achievable if the base can hold.

But the rally is likely to be short-lived, some analysts argued, noting that the measures might have a limited impact on propping up sales amid a difficult economic climate.

The Chinese government said on Wednesday that it would abolish urban real estate tax, as well as cut the transaction tax for properties with ownership of two years or less.

It added that it would encourage banks to extend credit lines to developments in the mass-market housing segment.

Bigwigs in the property market - CapitaLand and Keppel Land - saw the biggest jump among sector peers with their exposure to the mid-tier Chinese market.

Shares of property bigwig CapitaLand surged 16.6 per cent over the last two days to end at $3.30 yesterday while shares of Keppel Land jumped 20.9 per cent to finish at $1.79.

Yanlord Land Group - which targets the Chinese luxury segment - rose on the dovetails of the rally in property stocks on Thursday, rising 17.4 per cent to $1.01.

But the stock fell back 2 per cent to 99 cents yesterday, with analysts noting that these measures are not targeted at luxury players.

'As the overall policy still focuses on supporting the housing needs of the low to middle income homebuyers, high-end developers might not benefit substantially from these changes,' wrote DBS Vickers Securities analyst Carol Wu.

'While the policy environment has continued to improve, full recovery of the sector remains uncertain amid the deteriorating economic outlook,' she said, adding that excessive inventory would prompt developers to cut prices and that the property downcycle trend in China could drag on for as long as two years.

Reuters reported yesterday that an analyst from Morgan Stanley saw the sharp increases in shares of Keppel Land as 'premature and unjustifiable' as solvency and refinancing risks were non-issues for the firm.

It would take time before such fiscal measures filter down to the provinces, said Brandon Lee, an analyst from DMG & Securities.

These steps are also aimed at cushioning a fall in demand rather than to engineer sales given the expected rise in unemployment in China, said Barclays Capital economist Leong Wai Ho.

I think there all many experts mastering in the art of looking into crystal ball and potentially getting noble prize for it. Their only problem is that they are conveniently add in an extra zero or just omitting it.

I don’t think oil producing nations will keen to continue to pump out oil from ground just to sell it below cost for long.

“There is no precedent in fact in the modern era for oil prices to hit a bottom and just go sideways,” he said. “They hit a bottom and [the rebound] is U-shaped or Vshaped. It starts moving up quite quickly.

Oil is still searching for a bottom, and we’re not there yet. Analysts have been one upping each other lately with calls of US$20, US$25, US$30 oil. Mr. Bradford believes the bottom is in the US$30-toUS$40 range because that’s when significant Russian production comes under stress.

Chinese say: 祸不单行. I think this is what happening to General Motor.

Investors who put their fortunes in the hands of arrested New York money manager Bernard Madoff are waiting to hear how much of their stake is left.

The roster of potential victims in what prosecutors said was a $50 billion Ponzi scheme has grown exponentially longer in the past few days.

Madoff, 70, said in regulatory filings that he only had around 25 clients, but it has become apparent that the list of people who lost money may number in the hundreds or even thousands.

Among those who have acknowledged potential losses so far: Former Philadelphia Eagles owner Norman Braman, New York Mets owner Fred Wilpon and J. Ezra Merkin, the chairman of GMAC Financial Services, which owned by Cerebrus Capital Management, which holds a 51-percent stake, and General Motors.

From: http://www.cnbc.com/id/28212100

This may go crazy on Monday. There are rumours for takeover or M&A.

They are last traded at 29 cents. With an initial target of 40 cents from The Edge as follow, that is a 38% potential upside. Very tempting!

Biosensor is probably the most interesting chart from a punter’s perspective. Prices are approaching the top of the base formation at 31 cents. A breakout looks achievable. Quarterly momentum has turned up. Prices themselves have moved above the 50 DMA; RSI has risen above 50 and looks strong.

ADX has turned up from a low level, on the back of positively placed DIs. This is a bullish endorsement and should support a price break. Volume is expanding too. A successful break indicates an initial target of 40 cents.

Not much posting lately because the market has just started to turn bullish. I am busy to make real money now, ya, trying. :-)

I am long only retail investor in stock, except warrant.

Trade with care. Good luck!

Continue to read more...

Another month, another ghost without leg is coming out?

http://investsgx.blogspot.com/2008/11/rally-have-no-legs-it-is-ghost.html

BT:

On the back of hundreds of billions of dollars worth of stimulus packages, stock markets around the world have bounced off their lows of October and November - some by as much as a third.

But beware, say most market watchers. This is likely to be a bear market rally - its sustainability is questionable and it may retest previous lows again.

'It's hard to call it a bottom,' said Timothy Wong, head of regional equity research with DBS Vickers Securities. 'There's been a lot of selling the last couple of months. The market is oversold in terms of valuation. But there is still no clarity of the underlying economic fundamentals recovering.'

Terence Wong, head of research at DMG & Partners, shared this view. 'When news of more retrenchments and negative data comes out, prices are going to be hit again even though people say it's all been factored in.'

Meanwhile, a fund manager described what we have seen in the last few sessions as a 'relief rally'.

'Markets are relieved that governments around the world are pledging to spend billions to soften the worst economic downturn in our lifetime. However, there is no assurance that the problems we are in can be readily remedied by throwing money around,' he said.

Still, the rally - be it bear or bull - is much welcome. And some markets have enjoyed a much bigger surge than others. For example, Hong Kong's Hang Seng Index - despite shedding 2 per cent yesterday - is now a whopping 34 per cent off its low on Oct 28. China's CSI Index, which measures the 300 most representative A-shares on the Shanghai and Shenzhen stock exchanges, has rebounded by 25 per cent from its low on Nov 4.

At its Monday close, the US S&P 500 Index was 21 per cent above its Nov 20 low.

The Straits Times Index (STI), however, is a laggard. Following its strong 5.8 per cent surge yesterday, it is still only 9.6 per cent above its Oct 24 low of 1,600 points.

Bear market rallies can bounce as high as 50 per cent off their lows.

Norman Villamin, head of research and strategy, Citi Global Wealth Management Asia Pacific, has been expecting a bear rally.

'The backdrop today is very similar to what we saw in Japan in the 1990s,' he said. 'Prices have fallen significantly, down to book value everywhere except the US. What we are seeing now, which was missing in the past one year, is a sense of confidence that there will be some demand out there.'

US President-elect Barack Obama's details over the weekend of a stimulus plan to put 2.5 million people back to work in the next two years and talk of a second stimulus package from China give the market confidence that there will be some demand which can be counted on, said Mr Villamin.

But based on past experience - the most recent being the US$150 billion package announced by the US government in May - the effect of an injection on the markets lasts just 4-6 months.

'For a sustainable recovery, we need to see one or more of the following taking place,' said Mr Villamin.

One, in addition to the public sector spending, demand must also come from the private sector. And this will happen only when there are signs that the private sector's focus has moved away from deleveraging.

Two, the government stimulus package encourages US corporates to start investing again.

Three, government spending is able to create enough jobs to make up for all the lost positions in the private sector.

Four, there is aggressive debt relief for individuals and private sector balance sheets. But this is unlikely to be a top priority.

Adding to that, a fund manager said the market also needs to see US housing prices stop declining.

David Lee, managing director and chief investment officer of hedge fund Ferrell Asset Management, added two more negatives which need to subside for stocks to see meaningful rallies: banks need to start lending again, and refinancing rates need to decline - and credit spreads must fall as a result.

But he's seeing some positives already. Redemptions lately have been much smaller than anticipated, and money supply in the US is growing rapidly.

Further, Mr Obama's economic strategy and his new team are seen as having a lot of credibility. Meanwhile, exchange rates have been fairly stable, and 'market participants, especially analysts, are beginning to focus on fundamentals as doomsday scenarios are norm and are no more an unanticipated event', he said.

'This Christmas is early and if we do not see aggressive selling in the third week of December, the market should be looking brighter ahead!'

So what should investors do?

Take profit on trading positions, said Mr Wong of DMG.

For longer-term investors, here is some advice from Citi's Mr Villamin: 'Take the current rally to rebalance your portfolio. Relook your liquidity needs and take the opportunity to reallocate your assets so as to meet your long-term investment objectives. On a three- to five-year horizon, one can find value in the current market.'

Morgan Stanley Chief Executive John Mack told employees on Monday he would not get a bonus for a second straight year and announced compensation changes designed to more closely link pay with the bank's long-term performance.

Three weeks after Goldman Sachs and UBS executives announced plans to forgo bonuses, Mack in a memo said he and co-Presidents Walid Chammah and James Gorman will not receive bonuses this year. Mack also did not receive a bonus for last year, which was wrecked by nearly $10 billion of fourth-quarter trading losses.

"Our entire bonus pool will be down dramatically this year, reflecting the difficult market conditions, stock price performance and our full-year revenues in this challenging environment," Mack said in the memo.

Later Monday, CNBC reported that Merrill Lynch EO John Thain also asked that he not receive a 2008 bonus. A Wall Street Journal report had said he was seeking as much as $10 million for helping the giant brokerage avoid an even bigger crisis by selling to Bank of America

Technically, it looks like everyone who wanted to abandon ship has already done so, leading to an oversold condition in the counter. Price appear to be forming a possible double bottom, and perhaps a triple bottom.

While it’s early days, quarterly momentum has made a clear positive divergence with price, and appears poised to break out of resistance and its own moving average.

Twenty0ne-day RSI has broken out and is rising after a classic three-point positive divergence. The top of the double bottom provides resistance at 97 cents. A successful break would indicate a target of $1.24

Update: For some insight into China prospect:

https://www.dollardex.com/sg/investUT/pfiles/Market%20Focus%20China%20Nov.pdf

"While the Chinese economy has slowed more than expected, its economic fundamentals have remained intact. Strong retail sales figures showed that one of China’s central pillars of growth, domestic consumption, has so far helped cushion its economy against the slowdown in exports. Additionally, the government has already made a series of macro-economic policy adjustments which should ensure steady and sound economic development."

A widely expected U.S. cut later this month would take the target for the key federal funds rate to 0.5 per cent from 1 per cent.

A widely expected U.S. cut later this month would take the target for the key federal funds rate to 0.5 per cent from 1 per cent.

The problem with zero is that it dashes market expectations, which are based not on existing rates but on their direction.

In fact, once nominal rates reach bottom, most people will base their lending and spending plans on the assumption the only direction rates can take is back up. So cutting all the way to the bottom might be counterproductive.

Wait till you see this! A scene in London's Tube.

A scene in London's Tube.

Got the following news from an UK publication.

Seems like the western developed nation is started to shift the blame to China.

Not surprising.

CHINA has begun to devalue the yuan for the first time in more than a decade, raising fears that it will set off a 1930sstyle race to the bottom and tip the global economy into an even deeper slump.

The central bank has shifted the central peg of its dollar band twice this week in a calculated move that suggests Beijing aims to offset the precipitous slide in Chinese manufacturing by trying to gain further export share abroad.

The futures markets are pricing in a 6pc devaluation over the next year. “This is clearly a big shift in policy and we are now on alert,” said Simon Derrick, currency chief at the Bank of New York Mellon.

The move follows a speech by President Hu Jintao warning that China is “losing competitive edge in the world market”.

China has allowed a crawling 20pc revaluation over the past three years. Any reversal risks setting off conflict with the incoming team of PresidentElect Barack Obama in Washington. Mr Obama called China a “currency manipulator” during the campaign, a term that carries penalties under US trade law. Outgoing US Treasury Secretary Hank Paulson is viewed as a “friend of China”. He called for a stronger yuan this week before embarking on a visit to Beijing, but the plea was couched in friendly terms.

Hans Redeker, currency head at BNP Paribas, said that China’s policy switch could set off a dangerous chain of events. “If they play this beggar-thy-neighbour game, it will cause a deflationary shock The devaluation of the yuan being priced in by futures markets over the next year for the whole world,” he said.

It makes sense for countries with current account deficits such as the UK, US or Turkey to let their currencies fall, but China has the world’s biggest trade surplus.

Michael Pettis, a professor at Beijing University, said it was “very worrying” that a prodevaluation bloc seemed to be gaining the upper hand in the Communist Party. “We are on the brink of a very ugly period for trade relations,” he said. China has relied on exports to North America and Europe as its growth engine, making it acutely vulnerable to the contraction in global demand.

Prof Pettis said this recalls the role played by the US in the 1920s, a parallel fraught with danger. “In the 1930s, the US tried to dump capacity abroad, but the furious reaction of trading partners caused the strategy to misfire. China already seems to be in the process of engineering its own Smott-Hawley,” he said, referring to the infamous US Tariff Act in 1930.

China showed restraint during the Asian crisis in 1998, holding the line against domino devaluations. It may yet hold the line this time. However, this crisis is more serious. The manufacturing sector has seen the steepest decline since the records began. Civil unrest has begun to rock the Guangdong and Longnan regions.

Beijing has slashed rates and unveiled a fiscal stimulus of 14pc of GDP. However, most of the spending comes in the form of instructions to local governments to spend more – but without giving them the money.

1. European shares declined in early trading

2. DJ Future plunging lower by -144 (sure die die)

3. Oil price slump again to $47

4. Infineon Technologies reported a wider quarterly loss and warned that first-quarter revenue will fall 30%.

5. YOU ARE PESSIMISTIC !

American likes to talk about free market.

They used to criticize third world countries’ governments for subsidizing their farmers, manufacturing sector and etc.

However, their privately own public listed company is like a crying baby asking the government to bail them out. Isn’t that violating the rules of free market?

Read these news today:

GM's stock first fell after the automaker said its sales plunged 41.3% in November. The automaker then presented its plan to return to profitability, saying it would require up to $18 billion in federal money.

And these:

Away from the Dow, Ford Motor Co. said its sales slumped 31% in November. It then asked for $9 billion to return to profitability by 2011.

They should let the market decide the fate of these automobile giants if they really appreciate the spirit of FREE MARKET!

Perhaps, it is time for Hongqi to replace Chevrolet and Ford car.

Top UAW officials from across the country will meet in Detroit on Wednesday to consider key concessions in hopes of helping Detroit's automakers gain congressional approval of $25 billion in federal loans.

Automakers must submit plans to Congress today to show how they will use the loans. Ford Motor Co. planned to give Congress a clear picture of future, more-efficient models and General Motors Corp. readied a blueprint for cuts across the board.

UAW officials from Ford, GM and Chrysler LLC will meet Wednesday and later break off into meetings of representatives of the individual automakers.

One UAW local official who plans to attend expects the issues considered to include eliminating the jobs bank and further concessions in the way automakers fund the retiree health care trust.

Dark December

Dark December

In the wake of the most volatile month in memory, investors are looking for the smartest strategies for December. http://www.marketwatch.com/newscommentary/tradingstrategies

Stocks will enter the month of December with a sense of optimism that much of the dismal environment for corporate profits has already been discounted by the market, even as upcoming reports, including the key jobs report on Friday, are expected to show the economic picture is still worsening.

Next week, "we'll have a slew of economic numbers, including what I expect to be a rise to 6.7% in unemployment in November," said Peter Cardillo, market economist at Avalon Partners.

However, "the market has already priced in another quarter or two of real bad economic news, and that things could start to stabilize in the second quarter" of next year, he said.

Dow's best 5-day gain ever

The market gained on so-called Black Friday, marking its fifth-straight session of gains, with grim prospects for retailers failing to dent optimism at the traditional start of the U.S. holiday-shopping season.

MarketWatch

Time is really bad for KepCorp.

Property division (Kepland & KepBay Reflection) is heading into property grand sales next years.

Infrastructure division has a badly injured victim, Kep T&T falling from sky (>$5) to hell (<$1) in just a month times. Reit division (K-Reit) is presenting unbelievable super yield of 15%.

SPC just reported a 99 per cent fall in quarterly net profit. (Not One 99 shop, ok?!)

Of course, the newest and heaviest blow is reserved to Kep O&M: TALK.

KEP O&M is by far the biggest asset own by KepCorp. The ‘talk’ to arrive at mutually acceptable contract arrangement is bad but not the worst.

In more optimistic perspective, the ‘talk’ may not end in simple cancellation. The current total order book of $12.5 billion shall be enough to safe KepCorp until 2012 when global credit crunch subdued.

KepCorp is hovering 10% dividend yield on last Friday closing. Good buy or good bye? I choose the former.

YOU never know when a market hits bottom until well after the fact, but there have been a series of hints over the past few weeks that stock market investors may be flirting with one.

For one thing, volatility is easing. The Chicago Board Options Exchange Volatility Index , or VIX, is down about 8 per cent for the month and around 38 per cent below its 2008 peak hit last month.

A series of sentiment and flow indicators have also suggested this month that, while major investors remain very gloomy about the world around them, they are not getting much gloomier. On Thursday, Reuters asset allocation polls showed that, though leading investment houses continued to hold minimal levels of stocks in their portfolios, they had not reduced exposure this month.

The polls of 45 firms across the world showed equities rose a statistically insignificant 0.1 per cent month-on-month in an average balanced portfolio. Allocations were still well below the roughly 60 per cent long-term average for stocks, but they had levelled. This picture of gloomy- but-not-gloomier investors also emerged from other monthly surveys. State Street's investor confidence index for the month hit its lowest level in its more than 10-year history. But the month-on-month decline was a fraction of what was seen the previous month.

The custodian bank, which compiles its index from the buying and selling patterns of its clients, said that institutional investors were not reacting as strongly to deteriorating economic fundamentals as they had been.

'This month's readings provide a measure of relief,' index co-developer Ken Froot said.

Also gloomy, but with the odd shaft of light, was Merrill Lynch's monthly poll of some 180 fund managers across the world, released last Wednesday.

Although the poll showed investors currently believe the global economy is in recession and it is not going to come out of it for some time, there were signs of asset allocation shifts reflecting stronger risk appetite.

The percentage of fund managers who underweight equities dropped to 54 per cent from 62 per cent, for example, and a run on emerging market equities appeared to have levelled off with 30 per cent underweight versus 36 a month earlier.

Overall, Merrill's risk and liquidity indicator, drawn from the poll's findings, improved slightly. All this may be small beer, but it fits with an increasing number of investors who are arguing that, after falls of more than 50 per cent on many stock markets over the past 18 months, there are bargains out there.

Fortis Investments said this week that one of its tactical funds was moving back into equities and high-yield bonds in part because of value.

Templeton Asset Management's emerging markets funds are betting on a market recovery early next year, with MSCI's benchmark emerging market equity index having lost almost 60 per cent this year.

'Emerging markets have gone very far down and are now back to levels we saw in 2003. We think all these (government stimulus) programmes will start to have an impact in the early part of next year and then we will see a rebound,' said emerging markets guru and Templeton executive chairman Mark Mobius.

This siren song has been heard before, of course, and there is nothing to say that the signs of a levelling off and even renewed investor appetite will automatically lead to an eventual bounce in equities.

The bear market that began last year has already had a number of bounces, including a more than 20 per cent rise between the end of October and beginning of November for the MSCI all-country world stock index .

As analysts point out, bottoming out after steep market falls is a process rather than a specific event. Although in retrospect a bottom price can be identified, it tends not to be spotted at the time. From a process standpoint, the bottom of the last bear market, in 2002-3, came over a roughly five-month period. -- Reuters

WHILE most Singapore property developers are afflicted by the same predicament - over-supply, low confidence - the Chinese property market is as varied as its landscape.

Take property S-chip CentraLand for example.

Listed here in February, the price of Centra- Land shares at IPO is likely to have priced-in various poor economic data at the time. Even so, its IPO offer price of 50 cents has fallen only 4 per cent since, while share prices of most Singapore-based property developers are more likely to have fallen upwards of 60 per cent.

For the third quarter of 2008, revenue amounted to about 277.4 million yuan (S$62.1 million), recognised from delivery to buyers of 997 units of pre-sold retail and office units in its commercial property project, J-Expo in Zhengzhou.

Located in the Henan province, J-Expo is a wholesale commodities building in the heart of Zhengzhou city, located at the junction of the main road and rail network in central China. In a filing with SGX, CentraLand said Zhengzhou city enjoys good traffic and is an important wholesale centre, especially for women's apparel.

Not many would know this about Zhengzhou, much less know where it is. This being so, CentraLand, which is probably considered more 'exotic' compared to other China property S-chips, is not heavily traded.

Less exotic property S-chips like Yanlord, China New Town Development (CNTD) and Sunshine Holdings are traded more heavily. Their share prices have also fallen dramatically, in line with market movements.

Indeed, since the start of the year, Yanlord, CNTD and Sunshine share prices have fallen 80 per cent, 95 per cent and 92 per cent respectively to very low penny values.

But the paradox is that unlike Singapore (and much of the world) some markets in China, where some of these S-chips have projects, are actually seeing property prices recovering.

Citigroup analysts visiting numerous cities made several conclusions recently. They noted that inner cities like Chongqing and Chengdu looked less affected by the export slowdown and global financial crisis, as their economies are more domestic trade oriented.

In Chengdu, Citigroup added that activity has recovered slightly from the period immediately after the earthquake, but more importantly, it also sees a meaningful difference in terms of sales volume and prices versus the period before the earthquake.

Citigroup did not, however, notice meaningful rebounds in transaction prices and volumes in Shenzhen or Guangzhou, 'and the market is still clouded with the wait-and-see attitude of the potential buyers'.

Citigroup said that in Hangzhou, the provincial capital of Zhejiang province, the situation has been deteriorating, adding: 'As one of China's main export and manufacturing driven provinces, Zhejiang has been significantly impacted by the export slowdown and global financial crisis.'

On the other hand, Citigroup considers Shanghai as one of the most resilient in China, especially for projects located in prime locations. 'We don't see any significant price cuts in the high-end/luxury-end residential projects,' it said, adding that in the past two years, there has also been limited new land supplies in the city centre.

Different Chinese cities also appear to have different property cycles. DTZ Research reveals that property prices in Shanghai peaked at the end of 2005 and then plummeted for a year before rising steadily since the end of 2006.

DTZ's Shanghai property price index rose 40 per cent in Q3 2008 compared with the previous trough in Q4 2006. Prices continued to increased by 3 per cent quarter-on-quarter in Q3 2008 and 5.2 per cent compared with Q4 2007.

In Guangzhou and Shenzhen, however, property prices only peaked in Q4 and Q3 of 2007 respectively. While prices have recovered somewhat in Guangzhou - with the DTZ price index rising 2 per cent since the previous trough - Shenzhen prices have fallen 16 per cent since Q3 2007.

More interestingly, Beijing prices have been increasing for four years, registering an 8.1 per cent quarter-on-quarter increase in Q3 2008.

Each city appears to react to different micro-economic factors like land scarcity, high levels of speculation, or even the efficiency of local governments to implement policy changes (curiously, the Chinese government's relaxation on mortgage lending in October has not had an impact on share prices).

As such, finding value in the Chinese property market takes a lot of work. But at the same time, it should help to separate the wheat from the chaff.

The latest earnings season has been a chilly one for real estate investment trusts (Reits) hit by the credit crunch and a cooling property market.

Many Reits are working to shore up confidence in their credit positions. Property acquisitions are virtually off the table while industry watchers are divided on whether consolidation within the sector is on the cards.

'Reits are definitely paying more attention to financing,' said DMG & Partners Securities analyst Brandon Lee. The research house estimates that the sector has at least $4.5 billion up for refinancing in 2009 alone. With credit tightening and spreads widening, the market is watching closely for signs of trouble.

According to a CIMB-GK report, borrowing spreads for Reits have risen from an average of 150 basis points (bps) to 200-300 bps for three-year loans in the last six months.

'While average all-in cost of debt for most Reits has been contained within 4 per cent thus far . . . we expect the all-in cost for those with significant refinancing due in 2009 to rise,' said associate vice-president of research Janice Ding.

Reits have tried to soothe market anxiety in the past few weeks by releasing more details on debt. Ascendas Reit (A-Reit), for instance, won confidence votes when it said it had secured firm commitment of $200 million to help refinance a $300 million loan due in August next year.

Suntec Reit also made it a priority to refinance a $700 million loan due in December 2009. 'Whilst we have no major financing needs in the next 12 months, we are keenly aware of the liquidity crunch,' said the Reit manager's CEO Yeo See Kiat last month.

Reits also have to worry about asset devaluation as the slowing economy weighs down on rents and occupancies. Lower property values would raise gearing ratios. Frasers Commercial Trust (FCOT) booked a revaluation loss of $83.5 million in the third quarter ended Sept 30.

Reits have pushed asset acquisition plans to the bottom of the agenda. Even organic growth has slowed. Suntec Reit shelved redevelopment plans for Park Mall. CapitaMall Trust also held back enhancement plans for three malls because of high construction costs.

'We will review new commitments carefully and will not sacrifice our liquidity,' said the Reit manager's chairman Hsuan Owyang last month.

Analysts advise investors to be selective. While low unit prices have boosted yields, it would help to 'pay extra attention to (Reits') refinancing profile, especially the quantum of short-term debt due within the next six to nine months,' said DMG's Mr Lee in a note. 'We like S-Reits with strong sponsors (and) excellent track record.'

CIMB-GK's Ms Ding added: 'The presence of strong sponsors and government-linked sponsors is advantageous at this juncture.'

FCOT, for instance, managed to take a $70 million loan from parent company Fraser and Neave last week to repay debt. The trust is in talks to refinance the $70 million loan and all debt maturing next year. In response, Standard & Poor's Ratings Services took FCOT off 'CreditWatch' status and said that the outlook is stable.

ARA Asset Management Group CEO John Lim believes that consolidation in the sector seems unlikely because Reits would be more concerned about their own refinancing and asset valuation issues.

CIMB-GK's Ms Ding said that in today's market, it would be difficult 'for any single entity to have enough funds to buy over the entire (Reit) unless it's a distressed sale'.

But an industry observer believes that consolidation could happen because the sinking tide has left some Reits looking weaker than their peers. To avoid coughing up cash, a potential acquirer can offer units in itself to the target Reit, he added.

I am very surprise to see a High Note 5 related advertisement on my weblog.

As the advertisement read: Were you misled about the safety of your investment? Contact us.

Someone is coming out with cost to advertise on Adsense now. The exercise may gain more momentum soon with the victims started to group.

The Minibond saga is still hot and Hong Lim is still crowded. Part of the issues is allegation of misrepresentation and mis-selling by below qualified banking personnel to unsuitable group of customers.

I am not surprise to read in Singapore Salary Handbook by Kelly Services the following:

The text:

Position: Bank Teller

Job Description:

Handle high volume of over-the-counter transactions. Assist with customer enquiries, ensure service delivery standards are met & actively promote bank products and services.

The products and services could include Minibond? ILP? Endowment Plan? Insurance?

Guess what is the qualification required for them to discharge the duty to ACTIVELY PROMOTE BANK PRODUCTS AND SERVICES?

‘N’ levels with CO S / ’O’ levels

Maximum salary is $1,900

We have not seen any new IPO for about 2 months since the last. Whereas last year we may have 2 or even 3 IPOs running concurrently.

The latest IPO on hand is Otto Marine launches IPO at 51 cents apiece. They are an offshore marine group engaged in shipbuilding, ship repair and conversion and ship chartering.

If they launch their IPO one year ago, their share will be selling like hot cake, but no now. Instead, no one will bother to write a letter to newspaper forum to complaint that there are only 1 million shares for public offer out of total 235.3 million.

The application period is short, just 4 days.

My perception is that they do not even bother about the public response. The issuer probably has factored in lukewarm response.

Now, look at the history.

In last IPO, China Kunda has launched at 21.5 cent apiece and maintained the share price above water consistently throughout the most volatile month in near term history. China Kunda last traded at 24 cents now. Impressive despite the lack of liquidity (but with close spread).

The possibilities of share price ‘intervention’ by interested parties are high. The chance that Otto Marine to repeat the performance of China Kunda is relatively high.

The research report from DMG Research is very interesting in providing an overall outlook of STI in coming months.

The research report from DMG Research is very interesting in providing an overall outlook of STI in coming months.

STI closed at 1620 points yesterday and today may bounce up to test 1700 points resistance due to strong gain in U.S. market overnight.

For STI to hit 1391 points on January 2009, a further cut of 300 points in December 2008 alone is required. This represent a potential plunge of 17%.

Not impossible. We probably have to postpone the Christmas shopping spree to Chinese New Year!

The title is from breakingviews.com and I think the editor is humorous to link the latest development with Citi famous advertisement slogan.

The title is from breakingviews.com and I think the editor is humorous to link the latest development with Citi famous advertisement slogan.

Citi is paying 8 per cent dividend on US$20b of capital the U.S. government injected in the form of preferred shares. The housing loan board rate is about 4% in Singapore. How do they make profit from -4% gross returns from every loan dished out?

My formula is likely inaccurate, but, the cost of doing business by Citi is definately increasing.

The editor is quick to highlight that it isn't absolutely clear that Citi is out of the woods. As AIG has to come back for second time for rescue package, Citi may repeat it also.

As highlighted, the rescue doesn't address the diffuse concerns that the bank is either unmanageable or badly managed.

The U.S. government agreed Sunday night to rescue Citigroup Inc. with a plan that includes a $20 billion capital infusion and guarantees for up to $300 billion of Citi's troubled assets, according to media reports.

By MarketWatch

Last update: 12:34 a.m. EST Nov. 24, 2008

http://www.marketwatch.com/news/story/Citi-US-bailout-talks-reports/story.aspx?guid=%7B15A026EC%2DCEA0%2D4C82%2D92EC%2D199B794F0968%7D

If you still wondering why a rally of close to 500 points last Friday at Dow Jones has no impact to Asia markets, then you have not read/hear/watch any printed media/radio/TV this morning.

Here is three lines for you from ST today:

Any Asian rally today likely to be short-lived with sentiment still fragile amid tensions

Regional markets will enjoy an obligatory knee-jerk rise today and give them another opportunity to get rid of their stocks at a higher price.

Few traders expect the stock market rally to have legs.

We need a man to check and countercheck the system.

Tan Kin Lian for public office Petition

Sad to say, but have to admit that in last one year, yield-play stock is one of the most poisonous and dangerous investment.

Sad to say, but have to admit that in last one year, yield-play stock is one of the most poisonous and dangerous investment.

The market is volatile and spiral downward for the last one year. Even though there is no one sector being spare in this downturn, however, the temptation of high dividend yield has attract sizeable group of passive investor to join the massacre.

This is very true to REIT and shipping trusts in Singapore.

The minibond investors have risked full invested amount for potential 5% return.

The REIT and business trust is looking at the potential payout of 30.8% (MI-REIT) and 45% (FSL Trust) among the highest.

If the return is commeasurable with the risk, and vice versa, then, we may be waiting for another round of saga.

WHEN there is extreme uncertainty and volatility in financial markets, investors become unsure about where to park their funds. So holding cash may seem the safest option. But is cash really as safe an option as it seems - even now when a global recession is looming and asset prices are falling? The answer depends, among other things, on your risk appetite and investment horizon.

Before we delve into the topic, it is important to highlight that holding cash is not a risk-free option, especially when inflation runs ahead of interest rates.

In Singapore, for example, the annualised inflation rate in September was 6.7 per cent - substantially higher than fixed- deposit rates, which range from less than 0.5 per cent to less than 2 per cent, depending on the tenor.

Even at next year's officially projected inflation rate of 2.5 to 3.5 per cent, real interest rates - that is, the difference between deposit rates and the inflation rate - would still be negative. So those holding cash will still suffer wealth erosion.

So are you be better off investing your cash, given that equity markets seem more attractive after the recent huge correction? Our take is that investors should not let their guard down just yet - the outlook is still fraught with uncertainty.

Obviously, equity markets have come off very sharply. The MSCI World Index, for example, has sunk more than 40 per cent this year. In Asia, the correction in some markets has been even more pronounced, with bourses like China having declined more 60 per cent this year.

The sell-off has made markets less pricey, with forward price/earnings multiples now in the low teens or even at single-digit levels. Consequently, investors may find it tempting to go head-long into equities. However, this may not be the best strategy - and there are good reasons to stay cautious right now.

True, fears of the global banking system collapsing have eased and credit markets have shown signs of improvement. However, the situation is far from normal and it could take several months if not years before 'order' is restored.

Banks will need time to recover substantial losses and recapitalise their balance sheets. Hence, they are likely to stay cautious and may not resume normal lending any time soon.

We are already starting to see signs of forced selling and de-leveraging in the US$2 trillion global hedge fund industry. As funds' returns suffer, investors are pulling out money, while banks and prime brokers are cutting their leverage and demanding more collateral. As a result, hedge funds are forced to sell off assets to cover redemptions and meet margin calls.

In the US, the housing slump is hardly over. Home prices there are still falling and the rate of mortgage foreclosure is expected to rise in the coming months, especially when adjustable-rate mortgages are reset. Over the next two years, ratings agency Fitch has estimated that a sizeable US$96 billion of adjustable-rate mortgages will be reset higher.

Companies will also continue to unwind their debt holdings and investments, bought with the help of borrowed money, which will further drag down the market prices of many assets, including equities, causing yet more losses for investors.

Even if the central bank rescue efforts help calm conditions in credit markets and the nerves of jittery investors, this may not be enough to prevent a drawn-out global recession. Also, the write-downs may not be over. Global financial institutions may need to make more provisions as the value of assets on their balance sheets could diminish further and losses will be realised if these assets are sold at current market value. Given the risk of a deep and protracted recession, corporate earnings forecasts for next year, which appear to be too optimistic, may miss the mark in coming quarters, and this is another factor that could weigh on equity markets as profit estimates are cut. Given the risk of further downside, those who are looking to bargain-hunt at this time must have a strong risk appetite and a long-term investment horizon, as equity markets are likely to remain volatile and full recovery may not take place for several months at least.

Anyone looking to buy now should also spread their investments out over the next few months, instead of trying to time the markets. Time diversification aside, investors should also stay diversified across asset classes to protect against downside. It is especially important at this time not to get carried away with specific themes - no matter how appealing they may seem - and over-invest in them.

Despite the current turbulence, equities are still a good long-term bet and markets in Asia and emerging regions should resume their uptrend once the dust settles. However, this does not mean you should plough all your investments into equities. Instead, work out a suitable asset allocation strategy based on your risk appetite and long-term goals. If you're not sure how to do this, seek the help of a qualified financial adviser.

Staying largely in cash for now may seem like a good option if you are convinced that markets have not bottomed. But buying at the bottom is also near to impossible - so if you are afraid of missing the boat, then go ahead and nibble.

Investments are necessary to grow your wealth. Staying in cash for too long is clearly not a long-term option, because the negative real return will erode your wealth and leave you worse off in your golden years. Investments are still a good way to growing your wealth and the current turmoil in markets will throw up attractive opportunities for those with the risk appetite and the foresight to look beyond the current crisis.

Vasu Menon is vice-president, group wealth management, OCBC Bank

The fact that U.S. stocks have nose-dived into lowest level in more than 11 years is good reason to expect some form of rebound.

It is not likely that U.S. Congress will ignore automakers when they have generously come out with close to trillion dollars to rescue financiers.

The good news now is that: There is no un-known bad news.

The Asian markets have plunged for a ninth straight session and that shall bring out reasonable number of bargain hunters, and, that include MYSELF.

Nonetheless, bottom fishing shall be progressive. Use cash which can be spared for at least 5 years ONLY.

Straits Asia, Noble and Olam plunge more than 12%; key commodities index falls sharply

Straits Asia, Noble and Olam plunge more than 12%; key commodities index falls sharply

MAJOR commodity-related stocks here were pummelled for a second day yesterday as investors fretted over slowing economic growth and falling demand worldwide for energy, metals and agricultural resources.

Shares in Straits Asia Resources, which owns two coal mines in Indonesia, plunged 14.5 cents or 19.3 per cent to 60.5 cents, extending its two-day loss to 25.3 per cent.

Chief executive Richard Ong bought one million shares in the open market at an average price of 67.6 cents yesterday, raising his direct stake in the company to 0.592 per cent from 0.501 per cent, according to a Singapore Exchange exchange filing. Straits Asia's shares have slumped 80.6 per cent this year.

Olam International, which supplies agricultural commodities worldwide, saw its shares fall 12.3 per cent to 93 cents, extending its loss since Monday's close to 23.8 per cent. Since the start of the year, its shares have fallen 66.9 per cent.

Shares of Hong Kong-based Noble Group, which manages the global supply chains of various raw materials in food, energy and metals, fell 14.9 per cent to 74 cents, down 23.3 per cent in the past two days. The shares are off 63.5 per cent this year.

In a report yesterday, Credit Suisse analyst Haider Ali cut his target price for Straits Asia to $1.20 from $1.25, while keeping his 'neutral' rating on the stock, citing lower estimates of coal production in the next two years due to a delay at one of its mines.

And earlier this week, Merrill Lynch downgraded its rating on Olam to 'underperform' from 'neutral' and slashed its target price for the stock to $1 from $2.60, after Olam's management said it would cut the proportion of debt on its balance sheet.

This means Olam's aggressive pace of growth in recent years will have to slow, said Merrill Lynch analyst Chong Han Lim. 'By our estimates, the reduced gearing would lower sales-generating potential 30-40 per cent. The revision appears voluntary, but the company is probably making the announcement ahead of the inevitable - bankers tightening lending standards.'

Prices across a broad range of commodities have been hurt badly by a severe deterioration in the global economic outlook, which has triggered fears among investors that the earnings of companies such as Noble and Olam will suffer.

The Reuters/Jefferies CRB index, a global benchmark for commodity prices, fell on Tuesday to its lowest close since Sept 26, 2003. The index, which tracks 19 commodities including aluminium, crude oil, gold and soya beans, has collapsed almost 50 per cent from its all-time peak on July 2 this year, as the financial crisis wreaked havoc on the world's biggest economies.

Physical trade of commodities has also been damaged by the seizing up of credit markets, with firms finding it harder and more expensive to get letters of credit - a common method of payment for goods in international trade - as banks shy away from guaranteeing payments.

International trade is expected to slump 2.5 per cent next year, the first decline since 1982, hurt by shrinking demand and a sharp contraction in trade finance, the World Bank warned last week.

Can't even type the important date probably.......

Quote from the announcement:

The second paragraph of the notice referred to “27 November 2008” which was a typographical error. The date is 28 November 2008, as stated in the separate announcement relating specifically to books closure, also issued yesterday.

http://info.sgx.com/webcoranncatth.nsf/VwAttachments/Att_532C29E5C8C348204825750100232741/$file/081114_Clarification_of_Books_Closure_Date.pdf?openelement

Okay, just rumbling. However, it is really hardly find good reason for today's sell down.

Any?

Continue to read more...TANJONG Pagar town council said yesterday that it did not buy any Lehman Brother bonds directly but that one of its fund managers, Lion Global Invest, bought $250,000 of Lehman bonds.

This translates to 0.14 per cent of the council's $179 million sinking fund.

The disclosure comes after Parliament heard on Tuesday that Holland-Bukit Panjang and Pasir Ris-Punggol town councils invested a total of $12 million in DBS High Notes, Lehman Brothers Minibond Notes and Merrill Lynch's Jubilee Series 3.

Six other councils, including Tanjong Pagar, reportedly invested a total of $4 million in Lehman Brothers via portfolios.

Tanjong Pagar town council said yesterday that it is in a strong financial position and takes a prudent approach with council funds. Some 22 per cent of its sinking fund is handled by fund managers, but the bulk of its investments are in fixed deposits and government and statutory board bonds.

Its fund managers were given a mandate to invest over a three-year period, and funds are regularly reviewed by the town council, though the portfolio mix is left to the fund managers' discretion, the town council said.

About 50 homebuyers walked away from deals in October

About 50 homebuyers walked away from deals in October

BizTimes 18 Nov 08

The number of private homes returned to developers shot up last month on the back of a sharp dive in confidence due to the stockmarket crash.

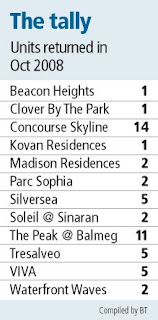

Homebuyers returned 50-odd units to developers in October, compared with 10-plus units each in the preceding month and in October last year. The figures were estimated by BT from statistics on developers' sales released by the Urban Redevelopment Authority (URA) yesterday. The figures exclude executive condos.

October also saw developers launching and selling the lowest number of private homes since URA started making monthly housing sales data available in June last year. Developers sold 112 private homes in October, down about 70 per cent from 376 units in the preceding month and 80 per cent below the 566 units sold in October last year. The 159 private homes developers launched last month was also 79 per cent lower than September and 75 per cent below that in the same year-ago period.

Buyers who returned the 50-plus units last month probably did so before the options were due to be exercised, industry observers reckon. Buyers who walk away from a deal before the option is exercised forfeit a quarter of the 5 per cent option fee, equivalent to 1.25 per cent of the purchase price of the unit.

'The stock market was at its worst in October. So some buyers may have got jittery and decided it was better to forego 1.25 per cent of the purchase price - that's $12,500 for a $1 million property purchase - than to be saddled with uncertainty. They worry that property prices may drop much further in the next six months. So it's a matter of weighing risks, even for people who can afford to take the hit,' said a seasoned property agent.

Another industry observer said another factor for the forfeitures could be if buyers failed to secure the required quantum of housing loan from banks, which have become more cautious in lending. 'Some buyers may also have observed developers trimming prices and got cold feet,' he added.

On a brighter note, he does not expect the number of units returned to developers to keep rising in the months ahead. 'Anybody who buys now must have done his homework. Things are a lot clearer now.'

Agreeing, DTZ executive director Ong Choon Fah said: 'October was an exceptional month with so much stockmarket turmoil and fear all around. Hopefully, we won't get a repeat of this. People will be much more considered when buying homes henceforth and therefore the number of units returned should revert to a more normal situation.'

October saw a total of 14 units returned at Concourse Skyline at Beach Road, 11 units at The Peak @ Balmeg in the Pasir Panjang area and five units each at Silversea at Amber Road, Tresalveo at Marymount Terrace and VIVA at Thomson Road/Suffolk Walk. Nonetheless, all these projects still saw units being sold in October.

CB Richard Ellis (CBRE) said, based on transacted prices, prices have 'remained fairly stable for the past two months, with due consideration that factors such as floor height, orientation and liveable space affect prices'.

'However, it is very likely that the persistent thin volume will have a downward effect on prices. The sluggish sales momentum is likely to remain for the rest of the year as macro factors such as the economic recession and retrenchment will erode consumer confidence,' CBRE's executive director Li Hiaw Ho added. He predicts Q4 may see sales volume of around 500 units, a level last seen in Q1 2003.

Knight Frank director Nicholas Mak said that homebuying sentiment is expected to weaken in the face of economic and job market uncertainties. 'Launches are expected to be held back till at least after Chinese New Year 2009,' he added. The lowest-priced apartment/condo sold in October was a unit at The Linear ($554 psf) while the highest-priced unit was an apartment at Orchard Scotts ($2,407 psf).

Savills Singapore's Ku Swee Yong noted that despite a weak month, The Lakeshore in Jurong and Hillvista in the Hillview area crossed $1,000 psf. The $2,169 psf of land area achieved at Sandy Island on Sentosa Cove is probably the highest price for a landed home in Singapore, he added.

Around 63 per cent of the 112 units sold in October were in Outside Central Region. However, in terms of the 159 units launched in the month, the lion's share (46.5 per cent) were in the Core Central Region.

The Edge- 16 November 2008

The Edge- 16 November 2008

Property counters were among the first sectors to peak and turn down in June 2007. While few believe that the bear market could possibly have come to an end, some signs are emerging that selected counters could be gaining strength against the sector and the market. Strangely, the stocks are not among the top picks by analysis.

Capitaland was recently downgraded by several analysts, yet the stock is showing signs of superior relative strength. Wheelock Properties is the other counter that has strengthened against the market.

Capitaland – Attempting to bottom

City Development – No change in direction yet

Keppel Land – Still weak

Guocoland – Rate of decline slows

United Overseas Land – Early signs of a base formation

Wheelock Properties – Attempting to form a base

US is first world country.

US is first world country.

China is third world country.

US has to spare no effort to approve the $700 Billion bail out plan to restore confidence in the volatile investment market.

However, China has rolled out $586 billion stimulus package like just a small change. China do not need bail out fund too.

The centric of the financial world may be tilting after the crisis.

Let's see.

Warren Buffett’s Berkshire Hathaway Inc. fell below $100,000 a share for the first time since 2006, dropping for a fourth straight day after posting a 77% profit decline on Nov. 7.

Berkshire slipped US$6,283, or 6.1%, to US$97,050 at 12:40 p.m. in New York Stock Exchange composite trading. The Omaha, Neb.-based firm’s shares are down about 32% this year.

Berkshire has posted four straight profit declines, the worst streak in at least 13 years, on investment losses and falling returns at insurance businesses.

October’s slump in debt and stock markets reduced the value of Berkshire’s holdings and derivative contracts and caused shareholders’ equity to fall by about $9-billion during the month. “There have been larger declines in the rest of the insurance industry, and Berkshire isn’t immune to that,” said Bill Bergman, an analyst for Morningstar Inc. in Chicago. Bloomberg News

Who want to do a year end shopping for half the price condominium? You may do it this weekend in River Valley.

I read with interest the news that the price of condominium is plunging fast and the transaction volume is shrinking. The fact that luxury condominium Luma is going to be relaunched this weekend with about 50% discounts to last year $2,800 psf price tag is shocking.

When the market is red hot last year, the so call market expert is predicting that price is going to go up another thousand dollar psf. This is not dissimilar like analyst predicting that crude oil price will hit $300 per barrel when it hit $140 at peak. Crude oil is selling in less then $60 now.

Who need an expert now?

I am a little surprise with the opinion expressed by a reader’s letter to BT’s Mailbag yesterday: “Don't school kids in personal finance”

Here is the letter (in blue color again) and my personal comment:

I REFER to your editorial, 'Lessons from the Mini-bonds saga' (BT, Oct 30). I have to disagree with your suggestion 'to teach the most important basics of personal finance to our children in school ...'

Me too, but on yours. :-)

My reasons are that first, personal finance is not a subject that can be taught to children in their early teens as it requires a certain level of maturity.

When a person is matured then it will be too late to mould the financial behavior!

Second, a little knowledge may be dangerous.

Yah, but no knowledge is even more disastrous!

And third, it is likely that instead of developing the likes of Warren Buffet, we may end up creating a 'greed is good' mentality.

The objective of personal finance education is not to ‘develop the likes of Warren Buffet’ and it should never be. I did not realize that personal finance education is to instill ‘greed is good’ mentality?!

Therefore, the teaching of personal finance should be deferred until the children reach the tertiary level.

How many of Singaporean never reaches tertiary level? Some not even secondary! Why are they being deprived of personal finance education? Personal finance is affecting the life and living of themselves and their family for whole life!

In the schools, they should be taught fundamental human values which can lead to the building of a caring and sharing society.

We should not just repeating the fairy tales and not explaining to them how their parents able to afford and put food on the table!

Personal finance is not about teaching kids how to trade forex with margin leverage, but can be as simple as instill disciplin to keep extra pocket money into piggy bank.

Please start early!

Here is an interesting comment (in blue) from SGDividends on my previous post Capitaland Shortist Club and I am going to reply here:

Hey dude, do you mean that Capitaland will face download pressure on its price due to the rumour?

Yes! Cash is King and when you decided to distant yourselves from the King during credit crunch time, you will be disliked by the market.

This Sand pie is huge to be swallowed alone or in half. By putting so many eggs into a single basket will definitely attract research houses to downgrade the stock price to reflect higher risk exposure for sure. When property price is poised to slide further next year, the appetite for risk is pretty low.

Even at current stage, the price tag is unlikely to be fire sale price. Simply put it, the seller is not desperate enough with government clear backing now.

Shouldn't it be a good news for Capitaland, just wondering?

Casino is evil good business but not an IR. These IR is generally expected to lose money for a few initial years before they sucked enough winning to pay for the loan interest. If Capitaland use the same quantum of capital to seize up smaller distressed property and development in the region, I believe they will be able to give better return in area they are expert.

The key is: RISK and market don’t like RISK now.

Anyway they recently are looking to divest their industrial property. So rumour might have some truth.....

Divestment of their industrial property is old news. In fact, they have divested retail shopping mall and commercial property into REIT in Singapre and China etc. I don’t think they need to divest these property just to finance their potential bid, anyway. They are big enough to take it, but, at what COST?

If Capitaland is participating in Marina Bay IR, I think we can orgainize a premium "Capitaland Shortist Club" based in Raffles Hotel.

""CapitaLand is trying hard to play down expectations but in the eyes of some analysts, it has emerged as the frontrunner in the race to become Las Vegas Sands' (LVS) white knight. The fact that CapitaLand had participated in the Request for Proposal for both integrated resort (IR) sites here is fanning such talk further.""

--- BT 11 November 2008

Golden Agri Resouces – Huge Bargain?!

As tabulated in The Edge this week, Golden Agri has historic price earning ratio (PER) of 0.59 times, well below 1.

As PER is affected by 2 important parameters, there are 2 potential scenarios:

Scenario 1:

The stock price has dropped so low that the earning of Golden Agri in one year time is sufficient to cover not only in full, but exceed all the capital invested now.

Scenario 2:

The earning of the stock is inflated, not sustainable and bound for deep correction.

However, the historical PER shown on Golden Agri home page has given a difference figure: 1.157 times.

As retail investor, I always have a problem to obtain the reliable data from free source when the figure difference in various sources. Nonetheless, Golden Agri seems to be a good bargain either in 0.59 or 1.157 times historical PER.

NAV $0.582 for a stock last traded at $0.205 is like a sexy babe waving at you: Simply tempting but dangerous (for guys, of course :-)).

Anyway, we have the choice.

Just want to quote an encouragement type of story (previously published on BT, if I am not wrong) to share with the group of investor who hunting for yield stock:

Altria, formerly Philip Morris, famous for its world's best selling cigarettes brand, Marlboro, was also very well known for its high dividend payments to its shareholders. A sum of US$1,000 placed in Philip Morris back in 1957, with its dividends reinvested, would have grown to almost US$4.6 million today, according to Jeremy Siegel's 2005 book, The Future for Investors.

**(Investsgx: Based on last Friday closing price, Philip Morris is traded at $42.20, with 52-week high $56.26 and 52-week low at $33.30. The range of trading price clearly indicated a classical behavior of blue chip with stable yield in bear market.)**

Investors who reinvest their dividends and accumulate more shares during the bear markets will eventually recoup the price loss because the lower price allows them to own more shares than they would be able to buy if the stock had not declined. Consequently, the value of these extra shares will surpass the magnitude of the stock price declines, making these investors better off overall.

**(Investsgx: Stay tune and cheers!)**

**(Investsgx: http://forum.channelnewsasia.com/viewtopic.php?t=195250

Dividend yield is relevant and will always relevant.

What we need to ascertain is to find out whether the company will be able to sustain its dividend payout over the long term.

Suggest to look at 2 payout ratio:

Payout Ratio of dividends as a percentage of free cash flow

Payout Ratio of dividends as a percentage of net income

The stocks with low payout ratio are more likely to sustain the dividend payout. For stocks which close to 100% or even more then that, we shall avoid it.

)**

Iceland was once considered one of the developed country before the financial crisis. However, their financial sector has collapsed and its inflation rate is potentially soar to above 20% in 2009.

Their previous unemployment rate is consistently low at about 2.5%, similar to Singapore. However, the unemployment rate is expected to hit 10% very soon.

Singapore has some similarity with the background of Iceland. Let’s wish the policy makers in Singapore learnt a lesson from Iceland failure.

Nonetheless, the public shall be vigilant in monitoring the government strategic. Not to be ignored, the elected President has handed over the key to Government to tap on the reserve to guarantee the deposit in the banks.

Open Quote:

THE just-announced government's move to suspend the sale of state land for the first half of next year 'was met with jubilation in property circles', reported The Business Times on Nov 1, 2008. The report also quoted a spokesman for City Developments as saying: 'We hope the government will continue to monitor the situation and introduce more pro-active measures to stabilise the property market.'

It is funny to read this because last year, when the Singapore property market 'became 2007's hottest global market with prime capital values increasing by 50 per cent', in six months (source: Jones Lang LaSalle, July 20, 2007), none of the Singapore developers then had urged the government to introduce pro-active measures to stabilise the property market.

The question is: should the government introduce more pro-active measures to stabilise the property market?

I don't think so. If the government is seen to always provide help to developers when their bets go wrong, then developers (and property speculators) will be emboldened to reckless risk-taking behaviour. Property developers and speculators made fantastic profits in good times.

In bad times, they should suffer the consequences of making the wrong bets. Let market forces rule. It is not the government's job to ensure that property developers and speculators come out tops every time. Let the possibility of failure and, real failure, be the necessary market discipline. Genuine buyers of property would be better served this way.

Close Quote

Since the reader posted the question, I would like to express my view too.

First of all, we should not expect any developers to release statement to hit their own toes. Secondly, the government did put up some curb to prevent the property price run away. The termination of deferred payment scheme is a good example. Next in my mind is that the government has raised development charge to slow down en bloc in 2007 too. These measures have successfully prevented the hard landing of property price, at least, up to today.

The second part of the question is: Should the government let the property developers and speculators fail?

The answer is directly link to the principle of free market with or without government intervention. This sound similar to either US government shall rescue the financial institutions or shall let them bankrupt. The academic argument can be very lengthy but without conclusion. In practical, this is not a choice. In the name of national interest, you have to do it and redo it again whenever required.

COSCO Corp Singapore's Cosco (Zhoushan) Shipyard unit yesterday announced that it is owed US$12.4 million by the owner of three Russian-owned fish processing vessels that it undertook repair works for.